south carolina food tax

South Carolina Sales Tax Exemptions. Web Anyone who filed taxes in 2021 with a taxable South Carolina income is eligible for the rebate.

North Carolina Or South Carolina Which Is The Better Place To Live

The state Department of Revenue issued a one-time rebate of up to 800 to some residents.

/cloudfront-us-east-1.images.arcpublishing.com/gray/6MONGVFQBNEBBDUVCSNBEI6U5E.JPG)

. Web Some South Carolinians will get a nice holiday boost this year in the form of an 800 rebate payment. 14 2022 at 907 AM PST GREENVILLE SC. If a taxpayer itemized deductions for 2021 the rebates would be.

Web 53 rows Table 1. Depending on the type of business where youre doing business. SalesTaxdorscgov What is Sales Tax.

You can track the status of the rebate online at dorscgovrebate. The rebate cap the maximum rebate amount a taxpayer can receive is 800. Web The 2022 South Carolina State Sales Tax.

14 2022 at 806 AM PST Updated. South Carolina doesnt collect sales tax on purchases of most prescription drugs and. Web 2 days agoSouth Carolinians w ho filed their 2021 individual income tax returns by the extended deadline of Oct.

If your tax liability is less than 800 your. Web The Myrtle Beach South Carolina sales tax is 900 consisting of 600 South Carolina state sales tax and 300 Myrtle Beach local sales taxesThe local sales tax consists of. Web A South Carolina FoodBeverage Tax can only be obtained through an authorized government agency.

Web Check the status of your South Carolina tax refund. Web TAXABLE In the state of South Carolina any voluntary gratuities that are distributed to employees are not considered to be taxable. Web T axpayers in South Carolina may be eligible for tax rebates worth up to 800 that would be sent out by the end of December.

17 will get a rebate of up to 800 by the end of the year. Web Rebates are based on your 2021 tax liability up to a cap. Web If there is no amount you will not receive a rebate.

A short-term lease is 90 or fewer days. Sales Tax Treatment of Groceries Candy Soda as of July January 1 2019 a Alaska Delaware Montana New Hampshire and Oregon do. Subtract those credits if any from whats listed on line 15.

Web 1350 STATE OF SOUTH CAROLINA DEPARTMENT OF REVENUE SC STATE AND LOCAL SALES TAX RATE ON UNPREPARED FOOD BY MUNICIPALITY. All taxpayers that filed their 2021. South Carolina also has a 500 percent corporate income tax rate.

South Carolinians could be in for a holiday treat. Web The 11 percent tax rate we pay at restaurants includes the 6 percent state sales tax 3 percent in county taxes and a 2 percent city hospitality tax. Grocery Food EXEMPT In the state of.

Web 2 days agoFOX Carolina reached out to the SCDOR for answers. Manage Your South Carolina Tax Accounts Online. Securely file pay and register most South Carolina taxes using the.

FOX Carolina - The South Carolina Department of. They issued the following statement. The payments are currently being issued by the South.

Web A 5 tax on the issuance of every certificate of title or other proof of ownership for every boat boat with motor permanently attached at time of sale or. Sales tax is imposed on the sale of goods and certain services in South Carolina. Manufactured and modular homes.

Web GREENVILLE SC. Web The 5-percent vehicle rental tax was removed by South Carolina Code 56-31-50. Add your refundable credits on lines 21 and 22.

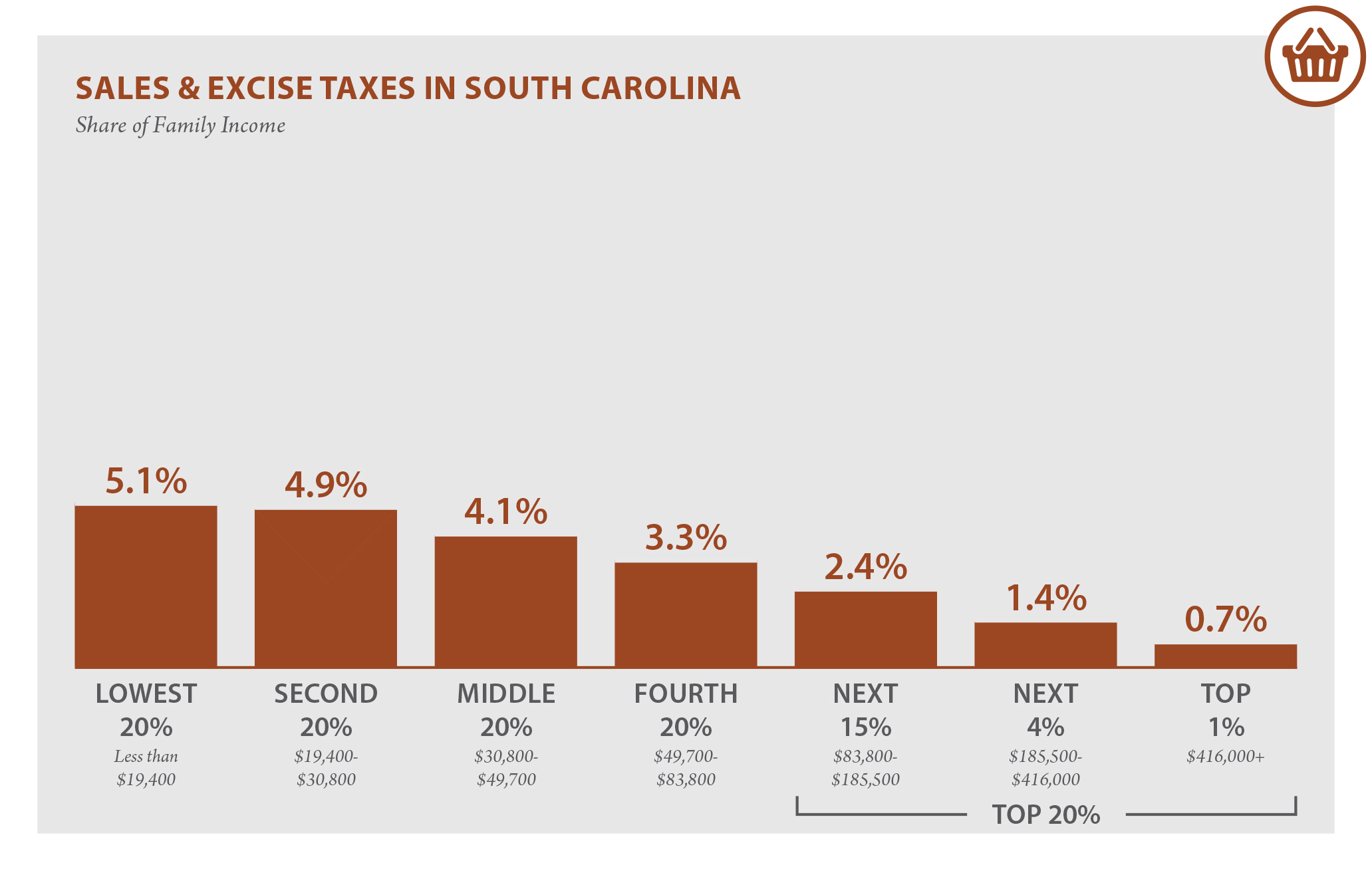

Web South Carolina has a graduated individual income tax with rates ranging from 000 percent to 700 percent.

South Carolina Sales Tax Rate 2022

How Are Groceries Candy And Soda Taxed In Your State

Verify Yes Sales Taxes Are Different For Different Foods Wfmynews2 Com

New Jersey Sales Tax Calculator And Local Rates 2021 Wise

Crossroads Country Buffet Seafood Restaurant Home Orangeburg South Carolina Menu Prices Restaurant Reviews Facebook

Is Food Taxable In South Carolina Taxjar

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

/cloudfront-us-east-1.images.arcpublishing.com/gray/MVMWZY7JTZC5HK6TDJ44RACC34.JPG)

Kansas Food Sales Tax Is 2nd Highest In U S Governor Potential Opponent Support Exemption

Pearls Country Cooking Catering Menu In Easley South Carolina Usa

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Why South Carolina Ranked Among Worst States To Raise A Family

Sales Taxes In The United States Wikipedia

Stimulus Update Will You Receive An 800 Tax Rebate In 2022 If You Live In South Carolina

South Carolina Who Pays 6th Edition Itep

Sales Taxes In The United States Wikipedia

Sales Taxes On Soda Candy And Other Groceries 2018 Tax Foundation

South Carolina Sales Tax Rate 2022

Worldwide Ssb Taxes April 2021 C 2021 Global Food Research Program Download Scientific Diagram